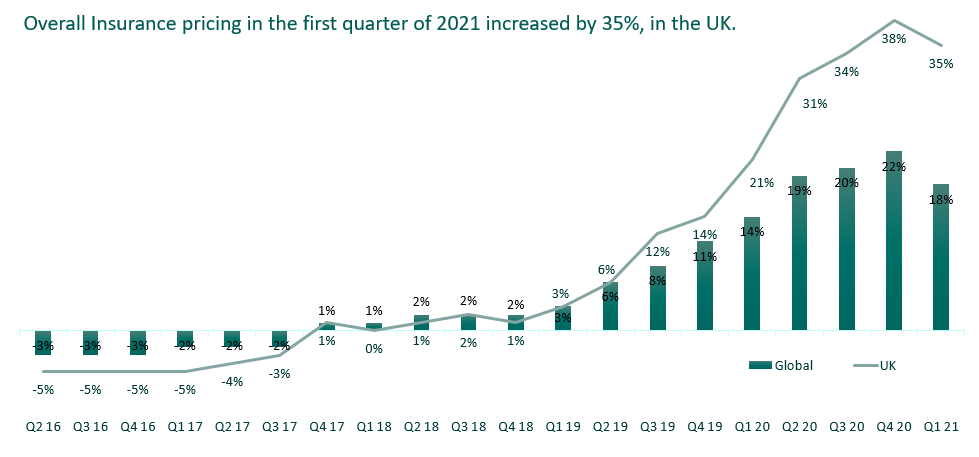

What’s happening to insurance premiums? It’s been an odd few years, to say the least. With politics, adverse weather […]

BCRS business loans

Grab a grant

There are several new initiatives designed to support growth for West Midlands businesses, so we thought we would share […]